Buying Property in the United States

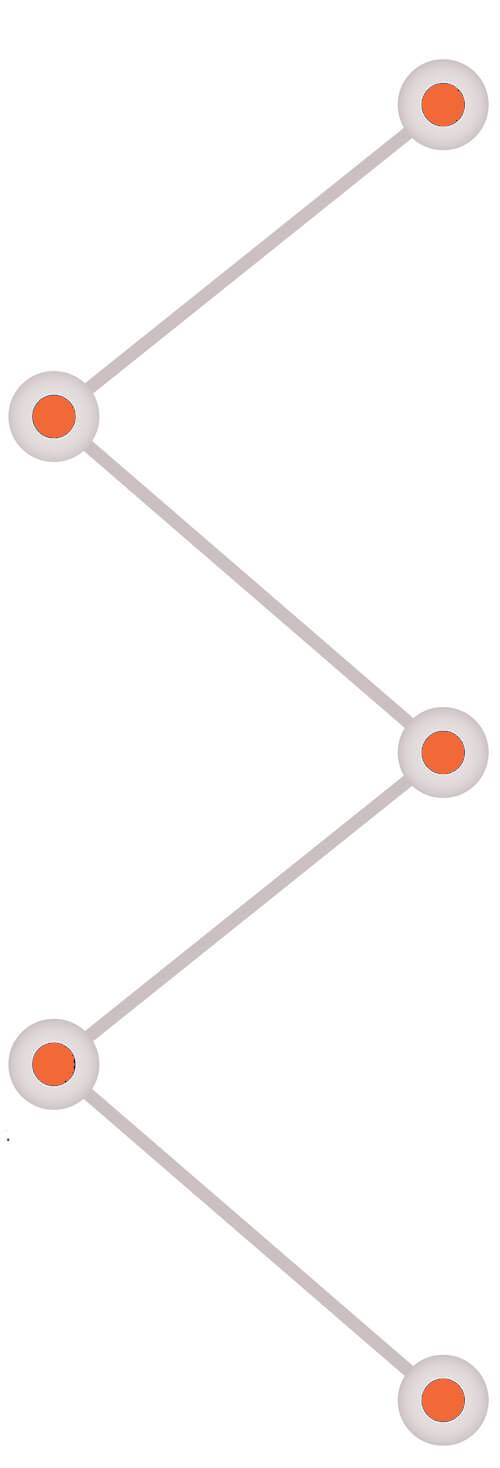

Once the contract is binding, the buyer generally deposits a downpayment into a "Trust" or "Escrow" account. The Buyer typically conducts a home inspection within 10 days. If a mortgage will be used the Buyer will apply for a mortgage. If it is a commercial property and environmental inspection will be required.

If the appraisal is lower than the contract price the parties may need to amend the contract or loan amount so that the loan is below a certain percentage of the contract price. Once the property has been inspected and appraised and the Buyer has obtained "loan approval" The lender will "order title" to insure that the Seller is the actual owner and that there are no other liens or parties who may assert a claim to the property. As a precaution the lender will require the Buyer to also purchase Title Insurance.

Negotiations between buyer and seller generally result in an an Offer. Once the essential terms of price, parties, subject matter and timing are accepted by both parties a contract is formed. In New Jersey, if this process was performed by a Realtor there is a 3-day Attorney Review period where either party may back out of the contract

Unless the contract must be amended because of unsatisfactory conditions during the inspection both parties are ready to proceed to closing. If using a lender, The Buyer's lender will order an appraisal of the property's value thereby commencing the mortgage process which may take 45 to 65 days. This will take longer for commercial property.

Once the "abstract of title" has been reviewed by both the Buyer and Seller, the buyer's lender will transfer all funds to the closing agent (Seller's attorney or Title Company) after which the parties will sign "settlement" papers evidencing the "closing" of the Seller's title to the property and the simultaneous opening of the Buyer's title to the property. The entire process is evidenced by a Deed which will be recorded by the County Registrar of Deeds.